Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

I have this childhood memory of my dad sitting at the kitchen table once a month and putting cash in envelopes. Each one was marked with something like groceries, miscellaneous, household bills, etc. I was a little too young to get the complete rundown of each envelope and how much they contained, but I got the jist of what he was doing.

Decades later, I heard personal finance guru Dave Ramsey talk about his envelope system. It brought back fond memories of my dad and the lessons he attempted to impart to me about budgeting, responsibility and the value of money.

As an adult, I had my own version of this envelope system but pretty much abandoned it as I dealt less with cash and more with debit cards, credit cards, and online payment systems. The world seemed to be going cashless and the envelope method seemed terribly antiquated.

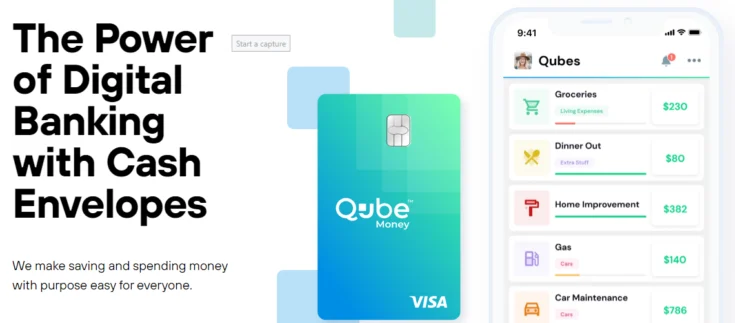

Enter Qube Money. This is a budgeting and banking app that puts a modern twist on the old envelope method.

There's an app and a card.

Here’s how it works:

You link your bank account to your Qube account.

Transfer funds from your bank to your new Qube account.

Then you make your own envelopes (called qubes) and designate particular amounts for each qube.

Like $250 for groceries, $500 for household bills, $500 for car-related items, $200 for clothes, etc.

You decide how much to put in each qube and how you want to divide up those funds.

Then, let’s say, you're at the grocery store.

You open the Qube app, see that you have $250 in your grocery qube, enter that you want that $250 transferred to your Qube card from the grocery category.

You make your purchase using the Qube card. If the total purchase was $100, that is paid to the store and the remaining balance in your grocery qube will be reflected as $150. It’s as simple as that.

One of the really cool things about Qube is that there are different plans to accommodate a wide range of needs.

There’s a Basic individual account that is free and includes: 10 qubes, a mobile wallet, and peer-to-peer transfers. There are two new features that are coming soon: bill pay and the ability to get your paycheck two days early.

There’s also Premium ($8 per month), Family ($15 per month) and Platinum ($25 per month) plans that offer more controls and permissions and the ability for multiple people (and kids) to use.

Because there is a history of purchases for each plan, it’s easy to keep track of everything.

I love that the app works in a way that’s easy to understand and let’s me allocate, budget and track the way I want. I feel like I’m melding the old and new. I know my dad is smiling that the way he did things has gone digital.

Start your budgeting journey with the Qube app here.