Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Many users of Afterpay have vouched that it is always easier and more convenient to use Afterpay than visa cards and other credit or debit cards since it is more adaptable, interest-free, and has an easy breezy approval process.

Afterpay allows customers to pay for later services or pay off their balance early, if available. You can pay off your Afterpay balances early. This way, you can eliminate the worry of missing any scheduled payments. It will also free you from any possible late fees.

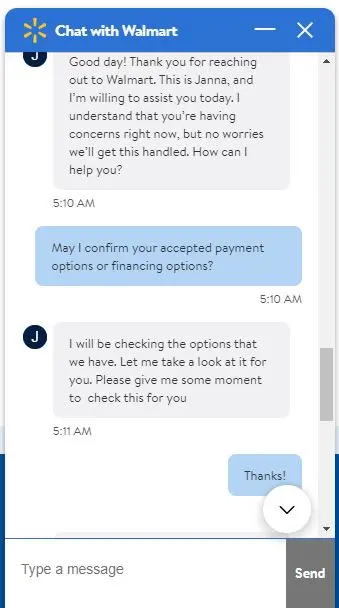

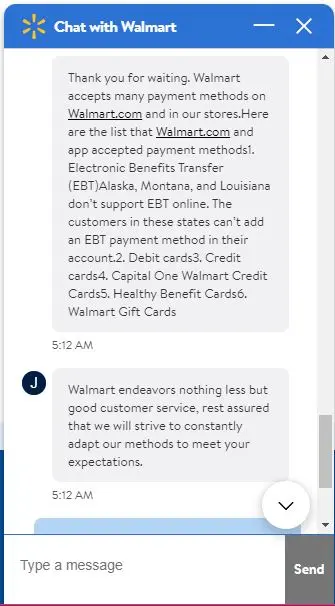

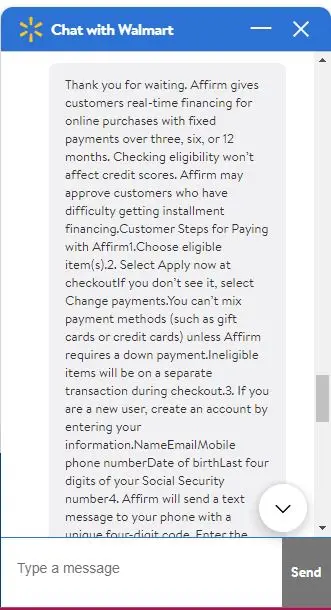

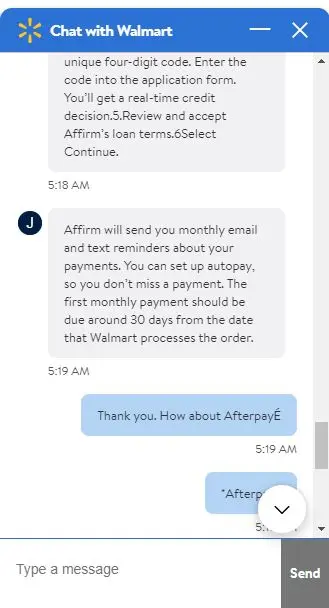

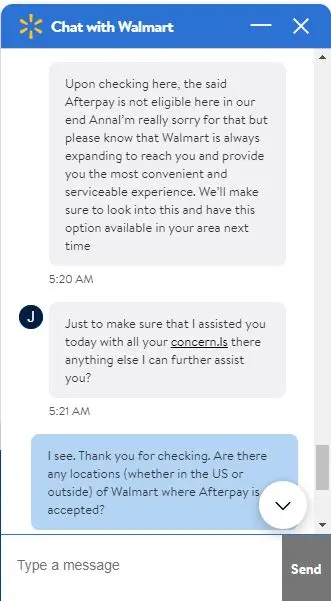

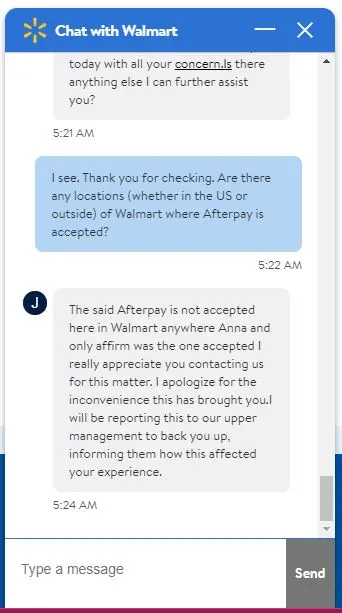

This article aims to inform and confirm to readers if branches of Walmart accept Afterpay financing as one of their payment options. Therefore, we spent some time chatting with one of Walmart’s representatives and verifying if they are taking the Afterpay financing option or a buy now pay later service. Later on, you will see in this article the responses from the representative.

We have also researched to see what online articles say about whether Walmart accepts Afterpay, online or in-store purchases, and if not, if they take any BNPL financing.

In This Post:

What is Afterpay?

Afterpay allows and gives you that freedom to shop, choosing a store included in the Shop Directory, and if the orders are approved, you can select Afterpay as your payment method upon checking out. All you need to do is to ensure to create an account if you are planning to use this for the first time, and long-time customers need to log in to their accounts.

Afterpay supports drop shipping as retailers directly ship your orders after checkout. Suppose a consumer opts to go to an in-store shop and wants to use Afterpay as a payment method.

In that case, all you need to do is to install the mobile app on your mobile phone as you do to all apps, follow all the instructions to setup the Afterpay Card, and in just a few steps, you can start using both with Apple and Google Pay ensure contactless payments.

Where and When Afterpay Started

Afterpay is one of the recognized buy now pay later services. Started in Australia in 2015 and premiered in the U.S. in 2018, Afterpay became popular among consumers who use interest-free payments that you can deliver within a certain period.

How Afterpay works

Afterpay assists you in your purchases so you can still proceed in receiving the items you bought even though it has not been fully paid for. During checkout, you can split payments into four installments, paid every two weeks within six weeks.

Most merchants require you to pay your first installment during the checkout before they ship out your purchase. After that, you can make in-store purchases or do it through the mobile app, so you can choose to use the Afterpay virtual Card for transactions to be contactless.

Afterpay works differently than other businesses that offer buy now, pay later. This means their customers will not be charged any fees or will not pay interest if they can pay on time. The total purchase amount you pay could be the same amount for the item. Afterpay earns through their partnered stores.

Pay later apps to hope to increase sales when they offer this payment plan to their customers. In addition, shopping has become more accessible and possible because of companies that pay for purchases, such as Afterpay and other apps.

You may be charged late fees, equivalent to $8 if you miss paying on time, capped at 25% of the order cost, but you can avoid this by being aware of your due dates.

Curious about other stores that offer payment plans for gourmet food and groceries? Dive into our companion article, “Buy Now, Pay Later Gourmet Food and Grocery Stores That Offer Payment Plans,” for a detailed list of establishments where you can use payment plans to indulge in culinary delights.

Why is Afterpay Worth Your Time

- Afterpay assists customers in managing their finances without affecting their credit score

- Helps pay for their purchases that customers cannot afford

- Easier and convenient

- It helps customers feel less guilty about purchasing even expensive items

Things to Consider When Using Afterpay

The late fees may start small but could go high if you do not pay on time

You cannot choose your payment plan or date

Once you start using the buy now later pay services, you tend not to stop buying anything, including outdoor home improvement or even crafts sports items

Taking a Deeper Look at Walmart’s

Who does not know Walmart? Founder Sam Walton had something right in him going when he decided to act upon his vision and mission and founded Walmart in 1962: the lowest prices anytime, anywhere. Indeed, what he started in Rogers, Arkansas, did not go to waste as there are now 10,593 stores worldwide, and it is the gift that keeps on giving as this continues to grow.

Walmart’s Current Payment Options

Customers can pay for their Walmart purchases using major credit cards like Visa, MasterCard, Discover, and Amex. They also accept gift cards, prepaid cards, and Walmart Gift Cards.

Walmart’s Take on Afterpay

Here is your response to our title, “Does Walmart accept Afterpay?”. Unfortunately, Walmart does not take Afterpay. Walmart is not one of the stores that accept Afterpay, whether in-store or online pay later apps.

Does Walmart accept Afterpay?

Below are screenshots of our sample chat with Walmart. We asked about their current payment methods; they accepted buy now, pay later, or financing services.

What Financing Options Does Walmart Accept

The screenshots above show our conversation with a Walmart Chat Support agent confirming that Walmart does not currently accept Afterpay as a financing service. Still, it offers to buy now, pay later options with Affirm. In addition, there are some write-ups online showing the Klarna app, and Paypal can be used to purchase items online through the buy now and pay later option. You can use this when you order from Walmart, but the website itself only offers to Affirm. Walmart Buy Now, Pay Later: A Comprehensive Guide to Flexible Payment Options

How Does This Compare with Afterpay

Afterpay will allow consumers to pay in monthly instalments (usually every two weeks for six weeks). In contrast, Affirm will let consumers pay the total amount in one payment, usually within a month.

How do you use Affirm on the Walmart website

- You may use Affirm online through the website by logging onto Walmart.com

- Select Affirm on the checkout page as your chosen payment method and

- complete the needed details

- Choose the payment plan that you think you can fulfil as a customer

- Follow your payment plan schedule

Benefits of Affirm:

- The benefit of Affirm is there are no late costs, service and prepayment costs, or hidden fees.

- Affirm’s on-the-go features allow customers to take care of purchases.

- Affirm is not a rotating line of credit not, like a regular credit card.

Are there any Drawbacks to Using Affirm:

- Affirm can check your credit history. However, the interest rates start from 10-30%; consumers avoid diving in and may want to check other companies first.

Does Walmart Accept Afterpay?

Walmart does not accept Afterpay as a buy now, pay later service, and Walmart’s official financing partner is Affirm. However, since Walmart is an ever-growing company, we do not doubt that it will continue to hasten and widen its accepted payment options where more buy now pay later services will be available both in stores and online.

Wondering where else you can Afterpay? Check out our list one Online Stores that Accept Afterpay.

Looking for gift cards for other stores? Check out How to Buy Gift Cards Using Afterpay.