Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Many users of Afterpay have vouched that it is always easier and more convenient to use Afterpay than credit or debit card since it is more adaptable, interest-free, and it has easy breezy approval process.

Afterpay allows customers to pay later services or pay off their balance early, if available. You can pay off your Afterpay balances early. This way, you can eliminate the worry of missing any scheduled payments. It will also free you from any possible late fees.

We have a separate article that talks about Walmart accepting Afterpay or not accepting it currently as a buy now pay later service. Same thing with this article, we aim to discuss and inform if Target takes Afterpay as a buy now pay later or BNPL method.

In This Post:

- Shopping at Target Using Afterpay?

- Get Exclusive Deals and Discounts

- Does Afterpay Affect Your Credit Score

- What You Should Know When Using Afterpay

- Checking Out the Origin of Target

- Does Target accept Afterpay?

- Other Options You Can Use Like at Target (Like Afterpay)

- Get Exclusive Deals and Discounts

- It's Never Too Late to Use Afterpay at Target, Start Today!

Shopping at Target Using Afterpay?

Source: pexels.com

A merchant that accepts Afterpay allows and gives you that freedom to shop, choosing a store included in the Shop Directory, and if the orders are approved, you can select Afterpay as your payment method upon checking out. All you need to do is to ensure to create an account if you are planning to use this for the first time, and long-time customers need to log in to their accounts.

Afterpay supports drop shipping as retailers directly ship your orders after checkout. Suppose a consumer opts to go to an in-store shop and wants to use Afterpay as a payment method.

In that case, all you need to do is to install the mobile app on your mobile phone as you do to all apps, follow all the instructions to setup the Afterpay Card, and in just a few steps, you can start using both with Apple and Google Pay ensure contactless payments.

Get Exclusive Deals and Discounts

Afterpay: Diving in Deeper

Afterpay is one of the recognized buy now pay later services. Started in Australia in 2015 and premiered in the U.S. in 2018, Afterpay became popular among consumers who use interest-free payments that you can deliver within a certain period.

Wondering if Target accepts Afterpay? While we have the answer to that question, if you're also interested in exploring other ‘Buy Now, Pay Later' options, don't miss our article on ‘Buy Now, Pay Later Gourmet Food and Grocery Stores That Offer Payment Plans.'

How Does Afterpay Work

Source: pexels.com

Afterpay assists you in your purchases so you can still proceed in receiving the items you bought even though it has not been fully paid. During the checkout method, you can split payments into four installments paid every two weeks within six weeks.

Most merchants require you to pay your first installment during the checkout before they ship out your purchase. You can choose to make in-store purchases or do it through the mobile app, so you can choose to use the Afterpay virtual card for transactions to be contactless.

Afterpay works differently than other businesses that offer buy now pay later. This means their customers will not be charged any fees or will not pay interest if they can pay on time. The total purchase amount you pay could be the same amount for the item. Afterpay earns through their partnered stores.

Pay later apps hope to increase their sales when they offer this payment plan to their customers. Shopping has become more accessible and possible because of companies that pay for their purchases such as Afterpay and other apps.

You may be charged late fees, equivalent to $8 if you miss paying on time, capped at 25% of the order cost, but you can avoid this by being aware of your due dates.

Does Afterpay Affect Your Credit Score

Source: pexels.com

- Afterpay assists customers in managing their finances without affecting their credit score

- Helps pay for their purchases that customers cannot afford

- Easier and convenient

- Helps customers feel less guilty about purchasing even expensive items

What You Should Know When Using Afterpay

Source: pexels.com

- The late fees may start small but could go really high if you do not pay on time

- You cannot choose your payment plan or date

Once you start using the buy now pay later services, you tend to not stop buying anything including outdoors home improvement or even crafts sports items

Checking Out the Origin of Target

Target started n 1962 in Roseville, Minnesota. Before it was called Target, the name was Goodfellow Dry Goods, and this start-up company began in 1902.

Fast forward to the present, in the United States, there are now 1,948 Target retail stores as of February 2023 and together with competitors Walmart, Walgreens, and CVS Pharmacy – these stores continue to help the people in their scope, including opening chances and options to customers who do not have the means to pay for what they need right away.

Source: pexels.com

For Target in store purchases, these are the accepted payment options that are listed on their website:

- Cash

- Personal Checks

- Mobile Payments such as Apple Pay®, Google Pay™, Samsung Pay, or any contactless digital wallet.

- Target RedCard™ (Target Debit Card, Target Credit Card, Target Mastercard

- Target Debit Card, Target Credit Card, Target Mastercard (including contactless payment)

- Target Temporary Slips (Target Debit Card, Target Credit Card)

- Third-party Credit Cards

- Gift Cards: Target GiftCards, Merchandise Return Cards, and Prepaid Gift Cards with the major credit cards.

- Gift Certificates: A Target Corporation gift certificate is good in the issuing country only.

- Merchandise Voucher: Target merchandise vouchers don't expire.

- Rebate Checks: Generally only pay for part of the cost of an item.

- WIC (Women, Infants, and Children) Program (approved in authorized stores only)

- Alipay is approved in some authorized stores only.

- Campus Cash is also accepted in several authorized stores only.

Target website and Target app accepted payment options:

- Target RedCard (credit or debit card), Target GiftCards, Target eGiftCards

- Third-party major credit cards (AMEX. Discover, Mastercard. Visa, Target PCard)

- Third-party debit cards as well as gift cards: must be connected with Visa or Mastercard and processed as a credit card

- PayPal except for items sold by Target Plus Partners.

- Apple Pay on Target.com and the Target app.

- SNAP EBT card purchases on Target.com and the Target app.

- Third-party installment plans such as Affirm, Sezzle, PayPal® Pay in 4, Klarna, Zip, and Afterpay

Does Target accept Afterpay?

As you see, Target accepts Afterpay payments as indicated above. Hurray! It means those patrons of Afterpay can confidently choose this as you finally decide to proceed with your

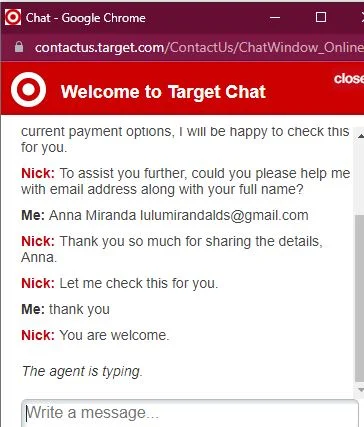

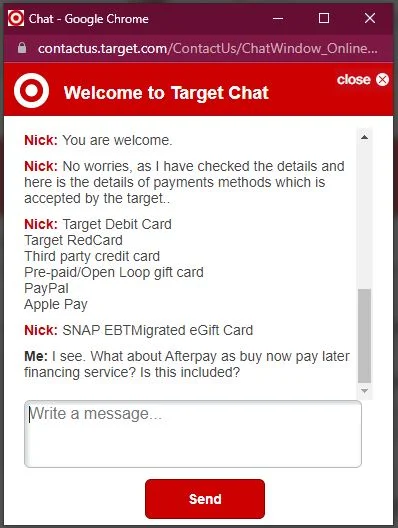

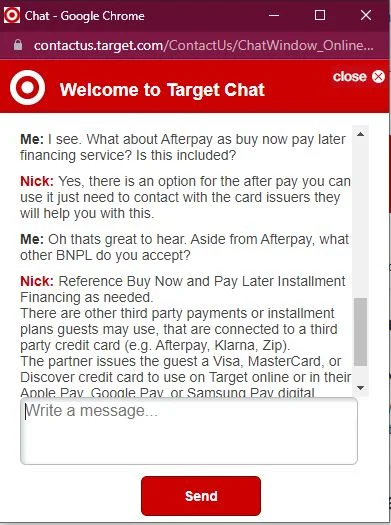

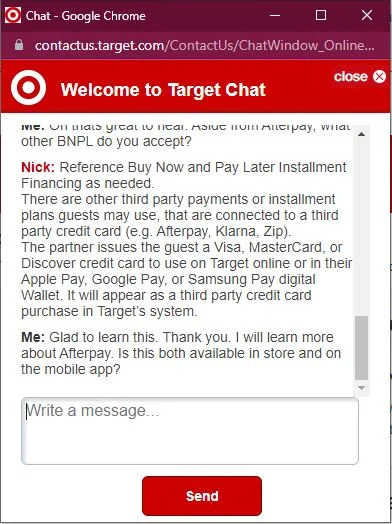

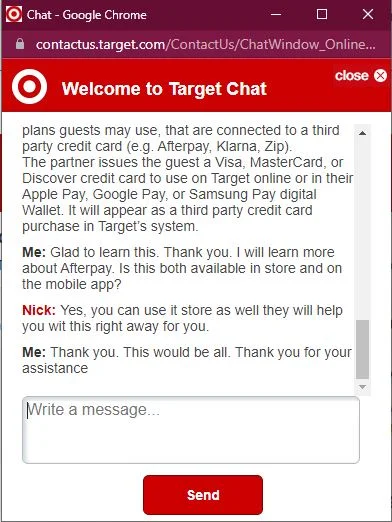

Target shopping cart purchases. Below is a brief chat we have had as a simulation to Target's preferred payment method/s, including digital payment method/s.

So no problem, customers can choose Afterpay which is a terrific alternative to your usual payment method for large purchase/s.

Meantime, we have also did a simulation by chatting with a Target representative to ask about their current payment options, their buy now pay later available services, and also their financing services.

We have included these images below:

Source: Target

Source: Target

Source: Target

Source: Target

Source: Target

Other Options You Can Use Like at Target (Like Afterpay)

Target's own financing options

It has Affirm listed on its website. Affirm is known to have fixed monthly payment/s, and customers can choose to pay over 3-12 months, usually within the three-month increment.

Affirm will not ask you to pay more than you agreed, and you can expect no late fees or other charges. If the items are worth $100 up to $15,000 with tax, and you have eligible products in your cart, you can use Affirm. It runs credit checks, and a down payment is probable. But it is a good financing option if you do not have enough money and need the product.

Other Buy Now Pay Later (BNPL) services accepted at Target

Other buy now pay later options that Target accepts are Affirm, Sezzle, PayPal, Pay in 4, Klarna, Zip, and Afterpay. These are listed explicitly under their available payment options if you use to shop online and through their mobile app.

Get Exclusive Deals and Discounts

How Are These Comparable with Afterpay

Generally, they all work the same – they allow you to shop and repay them eventually. They vary in terms of their fees and the repayment terms they offer. Some of these buy now pay later services extend their payment schedule up to 12 months.

Afterpay concentrates on their four equal installments. This means the price of the product you purchased is divided into four, and if you are a good payer and you pay on or before your payment schedule, you do not owe anything else aside from the price list of the product.

The Good Side of Using Afterpay at Target

- Shopping at Target would be a lot more convenient with Afterpay as your buy now pay later service

- Still, no interest

- If you are a good payer, you are not charged any extra fees, such as late payments

- Easy to set up

What You Need to Endure When Using BNPL Afterpay at Target

- Buy now pay later encourages you to shop more

- Spending limit

- Possible late fees

- credit checks

It's Never Too Late to Use Afterpay at Target, Start Today!

So there you go; we were able to establish in this article that online purchases and mobile app purchases on Target accept Afterpay. Now that Target is LIVE with Afterpay, shopping is more fun and more possible. Does target take Afterpay? Yes. And if you have not tried it, it is never too late!